Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Retaliation in the WTO Dispute Settlement System: Eucotax on European Taxation

The World Trade Organization (WTO) was established in 1995 with the aim of promoting and liberalizing global trade. One of the key mechanisms within the WTO is the Dispute Settlement System, which provides a framework for resolving trade disputes between member countries. In cases where a country is found to be in violation of WTO rules, the affected party can seek authorization to retaliate against the violating country.

In recent years, the European Union has faced several challenges regarding its taxation policies. One such challenge is the of the Eucotax, a new tax system that aims to harmonize European tax laws and ensure fair competition within the EU. However, this tax system has raised concerns among some non-EU countries, leading to potential disputes and the possibility of retaliation through the WTO Dispute Settlement System.

The Eucotax: A Brief Overview

The Eucotax is a proposed tax system that seeks to address the tax disparities among European Union member states. It aims to harmonize tax laws, prevent tax evasion, and ensure fair competition within the EU's single market. The system is designed to create a level playing field for businesses operating within the EU, eliminating any advantages that may arise from favorable tax regimes in certain member states.

4 out of 5

| Language | : | English |

| File size | : | 2109 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 312 pages |

The Eucotax proposes the of a common consolidated corporate tax base (CCCTB) across the EU. This would involve combining the profits and losses of all EU subsidiaries of a multinational company into a single tax base, which would then be subject to taxation at a standardized rate. The system also aims to combat tax avoidance by implementing stricter rules on transfer pricing and the use of tax havens.

Challenges and Concerns

While the Eucotax aims to promote fairness and consistency in taxation within the EU, it has faced criticism and concerns from non-EU countries. Some argue that the proposed tax system could be seen as discriminatory, as it may disadvantage non-EU companies operating within the EU's single market. There are concerns that the Eucotax could create barriers to trade, potentially violating WTO rules on non-discrimination and fair competition.

Non-EU countries may view the Eucotax as a form of protectionism, as it could limit their access to the European market. This could lead to potential disputes between the EU and these countries, prompting them to seek resolution through the WTO Dispute Settlement System.

Retaliation in the WTO Dispute Settlement System

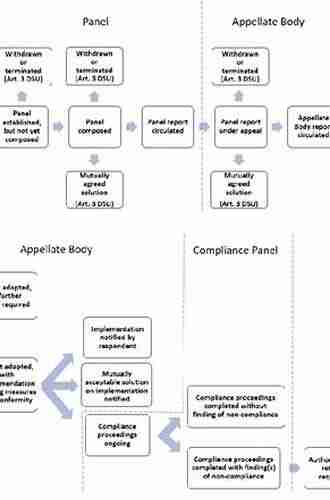

The WTO Dispute Settlement System provides a mechanism for resolving trade disputes between member countries. When a country believes that another member is violating WTO rules, it can initiate a dispute by requesting consultations. If the consultations do not resolve the dispute, the complaining party can request the establishment of a panel to hear the case.

If the panel finds that the respondent country has violated WTO rules, it may request the respondent to bring its measures into conformity with WTO obligations. If the respondent fails to comply, the complaining party can seek authorization from the WTO to retaliate. This can take the form of imposing tariffs or other trade restrictions on the violating country's products.

The Potential for Retaliation on Eucotax

Given the concerns surrounding the Eucotax and its potential impact on non-EU countries, there is a possibility that these countries may seek retaliation through the WTO Dispute Settlement System. If a non-EU country believes that the Eucotax violates WTO rules, it can initiate a dispute against the EU, arguing that the tax system creates barriers to trade and is inconsistent with non-discrimination principles.

If a panel finds in favor of the complaining non-EU country, it may request the EU to bring its Eucotax measures into conformity with WTO rules. If the EU fails to do so, the non-EU country could potentially seek authorization from the WTO to impose retaliatory measures, such as tariffs, on EU products.

The of the Eucotax within the European Union has raised concerns and potential challenges, particularly from non-EU countries. The harmonization of tax laws and the aim to ensure fair competition within the EU's single market may be perceived as discriminatory and create barriers to trade, potentially leading to disputes and retaliation through the WTO Dispute Settlement System.

It is essential for the EU to take into account the concerns of non-EU countries and ensure that the Eucotax is consistent with WTO rules on non-discrimination and fair competition. Finding a balance between achieving tax harmonization and preserving free trade will be crucial to avoid retaliation and maintain a stable international trading system.

4 out of 5

| Language | : | English |

| File size | : | 2109 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 312 pages |

Drawing on EU VAT implementing regulations, ECJ case law, and national case law, this ground-breaking book provides the first in-depth, coherent legal analysis of how the massively changed circumstances of the last two decades affect the EU VAT Directive, in particular the interpretation of its four specified types of establishment: place of establishment, fixed establishment, permanent address, and usual residence. Recognising that a consistent interpretation of types of establishment is of the utmost importance in ensuring avoidance of double or non-taxation, the author sheds clear light on such VAT issues as the following: ; the concept of fair distribution of taxing powers in VAT; role of the neutrality principle; legal certainty in VAT; place of business for a legal entity or partnership, for a natural person, for a VAT group; beginning and ending of a fixed establishment; the ‘purchase’ fixed establishment; meaning of ‘permanent address’ and ‘usual residence’; the position of the VAT entrepreneur with more than one fixed establishment across jurisdictions; whether supplies exchanged between establishments are taxable; administrative simplicity and efficiency; VAT audits and the prevention of fraud; the intervention rule and the reverse charge mechanism; right to deduct VAT for businesses with multiple establishments; and cross-border VAT grouping and fixed establishment. Thoroughly explained are exceptions that take precedence over the general rules, such as provisions regarding: immovable property; transport services; services relating to cultural, artistic, sporting, scientific, educational, entertainment, or similar activities; restaurant and catering services; electronically supplied services; transfers and assignments of intellectual property rights; advertising services; certain consulting services; banking, financial and insurance transactions; natural gas and electricity distribution; telecommunication services; and broadcasting services. As the first truly authoritative resource on a topic of increasing importance in international tax – a key topic for businesses, tax authorities, tax advisors, and government regulators – this book will be warmly welcomed by all professionals working with taxation in legal practice, business, academe, and government.

Anthony Burgess

Anthony BurgessEverything You Need To Know About Building Referral...

Are you looking for ways to boost revenue...

Aleksandr Pushkin

Aleksandr PushkinThe Fascinating History of Afro Uruguay - Unveiling the...

Afro Uruguay refers to the rich and diverse...

Anton Foster

Anton FosterReflections From Stubborn Son: A Journey of...

Have you ever encountered a stubborn...

Brennan Blair

Brennan BlairDiscover the Revolutionary World of Protein Modelling:...

Protein modelling is an essential...

Ricky Bell

Ricky BellThe Best Old Fashioned Advice: Timeless Wisdom Passed...

Have you ever turned to your grandparents,...

Isaiah Price

Isaiah PriceEmbark on an Unforgettable Journey: The Sword and Sorcery...

Are you ready to be...

Hassan Cox

Hassan CoxThe Enchanting World of Wendy Darling Comes Alive in...

Step into the magical world of Neverland...

Ivan Turner

Ivan TurnerAdsorption Calculations And Modelling Chi Tien: Unlocking...

In the field of chemistry, adsorption is a...

Harvey Hughes

Harvey HughesUnleashing the Full Potential of a Team: How To Organize...

"Genius is 1% inspiration and 99%...

Desmond Foster

Desmond FosterThe Fascinating Journey of George Romanes: From...

George John Romanes, born on May 20, 1848,...

Adrien Blair

Adrien BlairThe Untold Truth: The Bible In The Early Church - A...

Lorem ipsum dolor sit amet, consectetur...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Darnell MitchellThe Diary Of Super Girl: Exploring a Universe of Adventure, Power, and...

Darnell MitchellThe Diary Of Super Girl: Exploring a Universe of Adventure, Power, and...

Ernest J. GainesThe Ashes Diary: The 17th Man Summer Of Shove Australia 2013-14 Diary Of The...

Ernest J. GainesThe Ashes Diary: The 17th Man Summer Of Shove Australia 2013-14 Diary Of The...

David PetersonThe Ancient Magus Bride Supplement II: Unveiling the Extraordinary World of...

David PetersonThe Ancient Magus Bride Supplement II: Unveiling the Extraordinary World of...

Vladimir NabokovUnlocking the Secrets of Evolution: A Journey through Time with Darren Naish

Vladimir NabokovUnlocking the Secrets of Evolution: A Journey through Time with Darren Naish Edwin BlairFollow ·5.4k

Edwin BlairFollow ·5.4k John KeatsFollow ·10.9k

John KeatsFollow ·10.9k Easton PowellFollow ·13k

Easton PowellFollow ·13k Dean ButlerFollow ·18k

Dean ButlerFollow ·18k Orson Scott CardFollow ·10.3k

Orson Scott CardFollow ·10.3k John UpdikeFollow ·10.6k

John UpdikeFollow ·10.6k Andrew BellFollow ·16.2k

Andrew BellFollow ·16.2k Robert FrostFollow ·7.9k

Robert FrostFollow ·7.9k