Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

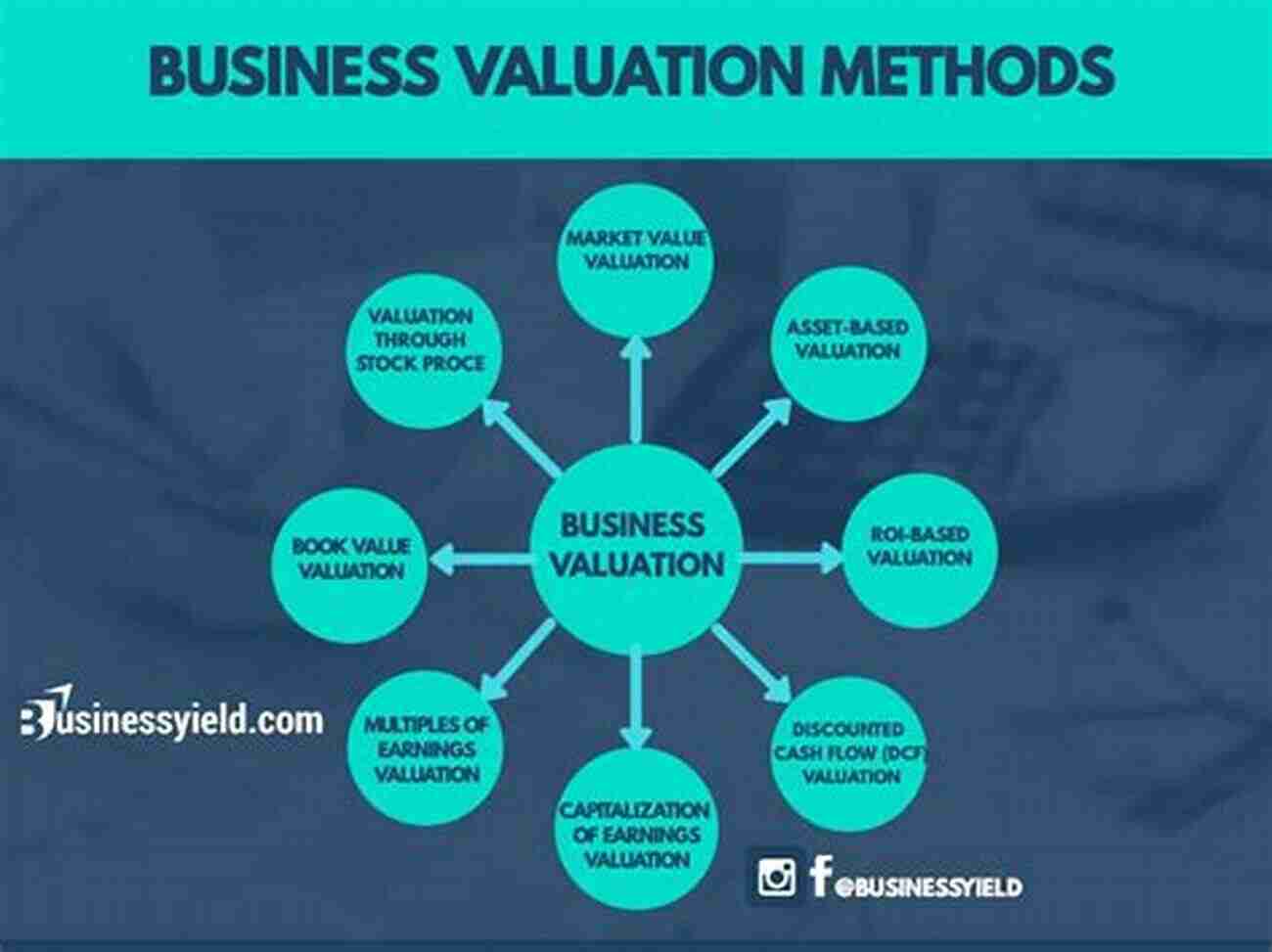

Small Business Valuation Methods - A Comprehensive Guide

Are you a small business owner looking to understand the true value of your company? Determining the value of a small business can be complex and challenging. However, it is an essential task for various reasons, such as selling your business, seeking investment, or planning for the future.

In this comprehensive guide, we will explore various small business valuation methods that can help you determine the worth of your venture. From financial ratios to market-based comparisons, we will dive deep into each method, discussing their pros, cons, and applicability. So, let's get started!

Understanding Small Business Valuation

Valuing a small business involves estimating its economic worth based on various factors such as assets, liabilities, market position, cash flow, and potential for growth. The process is crucial for any business owner as it provides them with valuable insights to make informed decisions.

5 out of 5

| Language | : | English |

| File size | : | 15947 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 216 pages |

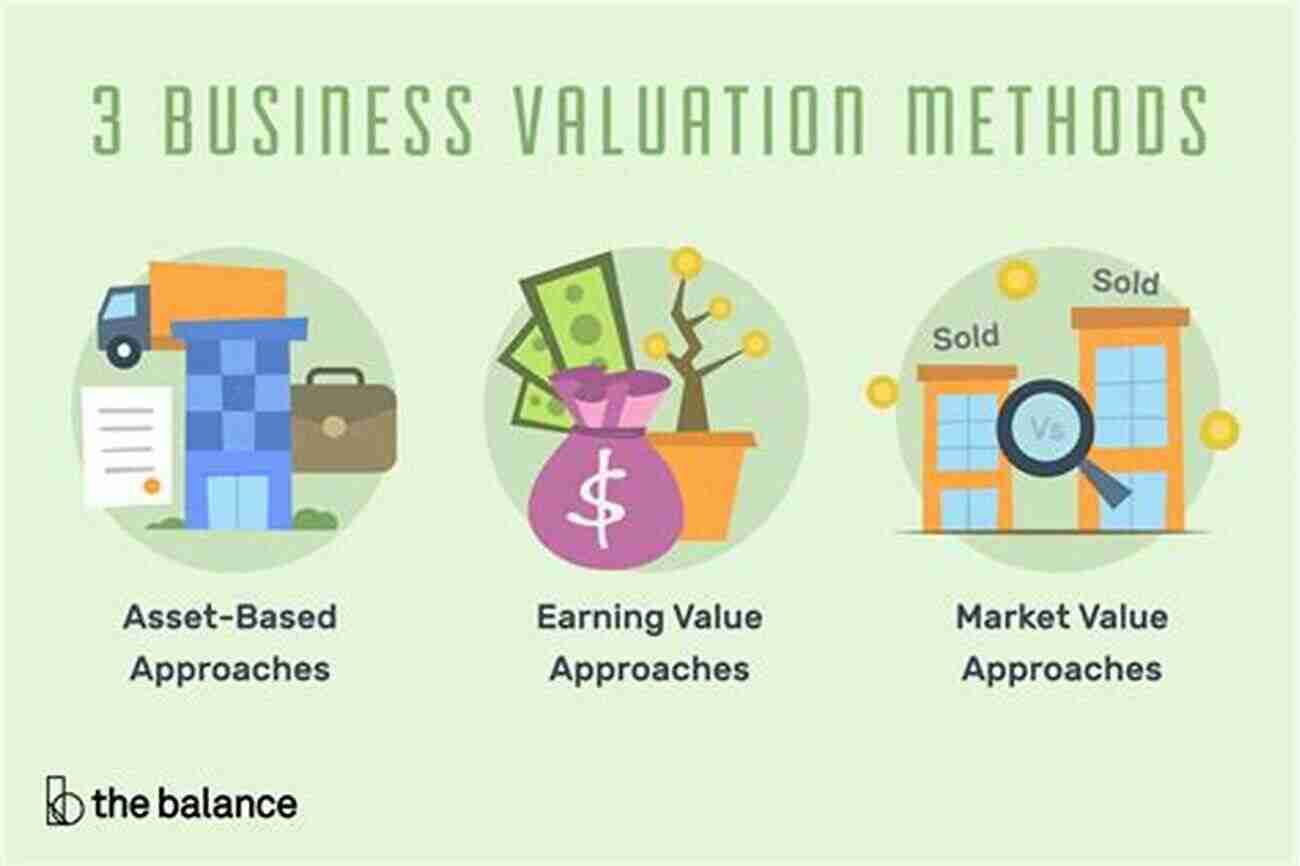

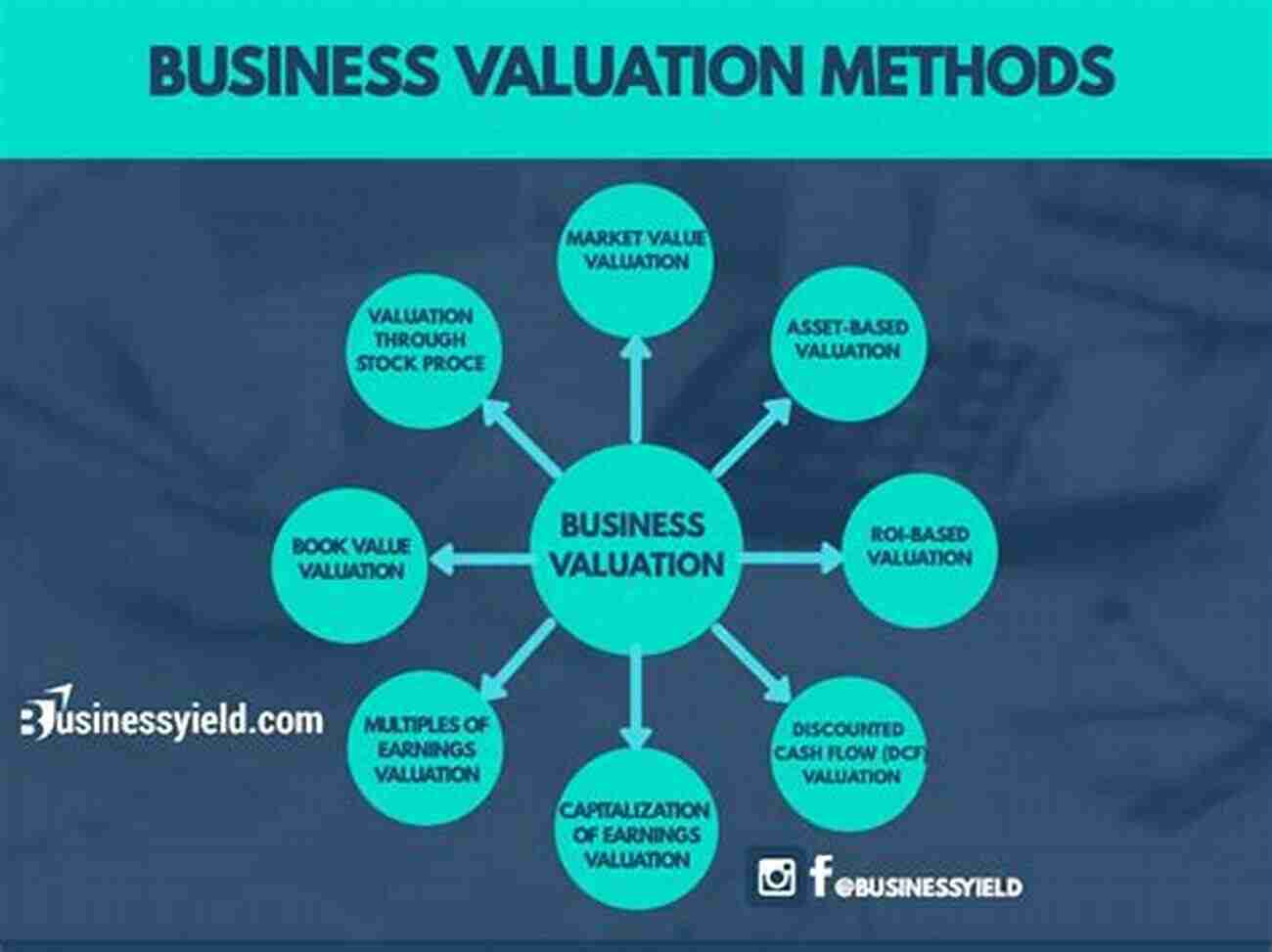

There are several valuation methods that professionals use to determine a business's worth. The unique characteristics of each method offer different perspectives on the company's value. Let's take a closer look at some of the commonly employed small business valuation methods:

1. Asset-Based Valuation

Asset-based valuation method calculates the worth of a business by considering the company's assets and liabilities. It focuses on the net value of the business's tangible and intangible assets after subtracting total liabilities. This method is commonly used for companies with substantial tangible assets such as real estate, machinery, or inventory.

Pros of Asset-Based Valuation:

- Provides a solid foundation for businesses with significant tangible assets.

- Relatively easy to understand and calculate.

- Helpful for liquidation or bankruptcy scenarios.

Cons of Asset-Based Valuation:

- Does not consider future earnings potential or intangible assets.

- May undervalue businesses with substantial intangible assets, such as brands or intellectual property.

- Less suitable for service-based businesses with few tangible assets.

2. Earnings-Based Valuation

Earnings-based valuation method analyzes a business's future earnings potential to determine its present value. It emphasizes the cash flow the business generates and forecasts the expected future profitability. This method is particularly useful for businesses with a solid track record and established customer base.

Pros of Earnings-Based Valuation:

- Considers the potential income the business can generate.

- Includes projected growth rates and risks.

- Puts emphasis on the profitability of the company.

Cons of Earnings-Based Valuation:

- Relies on assumptions and future predictions, making it less precise.

- May not be suitable for start-ups or companies without stable cash flow and established track record.

3. Market-Based Valuation

Market-based valuation method compares the small business being valued to similar businesses that have recently been bought or sold. This approach relies on market transactions and indicators to estimate the value. It is most useful for companies operating in industries with active merger and acquisition (M&A) markets.

Pros of Market-Based Valuation:

- Takes into account current market trends and transactions.

- Provides a benchmark using real market values.

- Helpful when there are many comparable businesses for benchmarking.

Cons of Market-Based Valuation:

- Requires access to market data and transactions.

- May not be appropriate for unique or niche businesses with few comparable competitors.

- Relies heavily on comparables, which may not be readily available.

4. Combination Valuation

Combination valuation method combines two or more of the above methods to arrive at a comprehensive estimate of the company's value. This approach acknowledges the strengths of different methods and attempts to mitigate their weaknesses. It provides a well-rounded perspective by considering multiple valuation angles.

Pros of Combination Valuation:

- Considers multiple factors and methods for a more accurate valuation.

- Addresses the limitations of individual methods.

- Provides a comprehensive perspective of the business's worth.

Cons of Combination Valuation:

- Requires expertise in multiple valuation approaches.

- Can be time-consuming and challenging to calculate.

- May still require judgment calls in combining the different methods.

Valuing a small business is a complex process, and no single method can accurately capture all aspects of its worth. The choice of valuation method depends on various factors such as the nature of the business, its industry, and the purpose of the valuation.

This comprehensive guide has provided you with insights into various small business valuation methods, including asset-based valuation, earnings-based valuation, market-based valuation, and combination valuation. Understanding these methods will equip you with the knowledge to evaluate your business's worth more effectively and plan for its future success.

Remember, it is always recommended to consult with a professional such as a business appraiser or accountant who specializes in small business valuations to ensure an accurate assessment that meets your specific needs.

Armed with this knowledge, you are now empowered to navigate the small business valuation process and make informed decisions for the growth and success of your venture.

5 out of 5

| Language | : | English |

| File size | : | 15947 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 216 pages |

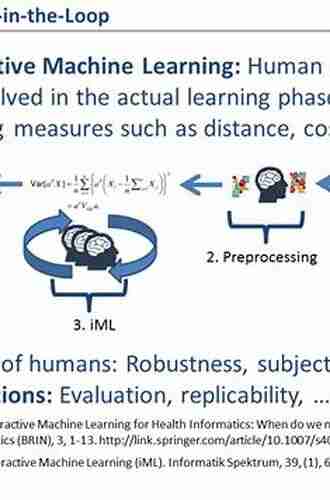

Valuation is the natural starting point toward buying or selling a business or

securities through the stock market. Essential in wealth management, the

valuation process allows the measurement of the strengths and weaknesses of a

company and provides a historical reference for its development.

This guide on valuation methods focuses on three global approaches: the assetbased

approach, the fundamental or DCF approach, and the market approach.

Ultimately, this book provides the basics needed to estimate the value of a small

business.

Many pedagogical cases and illustrations underpin its pragmatic and didactic

content. However, it also contains enough theories to satisfy an expert audience.

This book is ideal for business owners and additional players in the business

world, legal professionals, accountants, wealth management advisers, and

bankers, while also of interest to business school students and investors.

Anthony Burgess

Anthony BurgessEverything You Need To Know About Building Referral...

Are you looking for ways to boost revenue...

Aleksandr Pushkin

Aleksandr PushkinThe Fascinating History of Afro Uruguay - Unveiling the...

Afro Uruguay refers to the rich and diverse...

Anton Foster

Anton FosterReflections From Stubborn Son: A Journey of...

Have you ever encountered a stubborn...

Brennan Blair

Brennan BlairDiscover the Revolutionary World of Protein Modelling:...

Protein modelling is an essential...

Ricky Bell

Ricky BellThe Best Old Fashioned Advice: Timeless Wisdom Passed...

Have you ever turned to your grandparents,...

Isaiah Price

Isaiah PriceEmbark on an Unforgettable Journey: The Sword and Sorcery...

Are you ready to be...

Hassan Cox

Hassan CoxThe Enchanting World of Wendy Darling Comes Alive in...

Step into the magical world of Neverland...

Ivan Turner

Ivan TurnerAdsorption Calculations And Modelling Chi Tien: Unlocking...

In the field of chemistry, adsorption is a...

Harvey Hughes

Harvey HughesUnleashing the Full Potential of a Team: How To Organize...

"Genius is 1% inspiration and 99%...

Desmond Foster

Desmond FosterThe Fascinating Journey of George Romanes: From...

George John Romanes, born on May 20, 1848,...

Adrien Blair

Adrien BlairThe Untold Truth: The Bible In The Early Church - A...

Lorem ipsum dolor sit amet, consectetur...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Patrick HayesDiscover the Wonders of One Hundred Years And One Hundred Miles of Day Trips!

Patrick HayesDiscover the Wonders of One Hundred Years And One Hundred Miles of Day Trips!

Charles BukowskiThe Ultimate Step-By-Step Guide on Spindle Yarn Weaving: Spin with the...

Charles BukowskiThe Ultimate Step-By-Step Guide on Spindle Yarn Weaving: Spin with the... Kelly BlairFollow ·18.9k

Kelly BlairFollow ·18.9k Jake CarterFollow ·3.8k

Jake CarterFollow ·3.8k Edison MitchellFollow ·16.5k

Edison MitchellFollow ·16.5k Heath PowellFollow ·11.5k

Heath PowellFollow ·11.5k Anthony WellsFollow ·11.3k

Anthony WellsFollow ·11.3k Jace MitchellFollow ·15.2k

Jace MitchellFollow ·15.2k Earl WilliamsFollow ·9.2k

Earl WilliamsFollow ·9.2k Juan ButlerFollow ·18.9k

Juan ButlerFollow ·18.9k