Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Central Banks and World Markets: Unveiling the Symbiotic Relationship Impacting Your Finances

Imagine a world without central banks, where money supply and interest rates are left entirely to the whims of the free market. Chaos would surely ensue, jeopardizing the stability of our global economy and casting uncertainty on our financial well-being.

Central banks play a pivotal role in shaping world markets, wielding immense power through monetary policy and regulatory oversight. By delving into the intricate mechanisms at play, we uncover a symbiotic relationship between central banks and world markets.

The Role of Central Banks

Central banks serve as the guardians of our financial system, ensuring stability and promoting economic growth. Their primary objectives include:

5 out of 5

| Language | : | English |

| File size | : | 2017 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 80 pages |

- Controlling inflation

- Fostering full employment

- Managing interest rates

- Maintaining exchange rate stability

- Supervising commercial banks and financial institutions

Acts of intervention, such as adjusting interest rates or implementing quantitative easing (QE) measures, create a direct ripple effect on world markets.

The Monetary Policy Toolbox

Central banks manipulate money supply and interest rates through various tools, including:

- Open market operations

- Reserve requirements

- Discount rates

- Forward guidance

- Quantitative easing

The choices made by central banks in utilizing these tools have far-reaching consequences that reverberate throughout the global financial landscape.

The Impact on World Markets

Central bank policies heavily influence world markets, shaping the behavior of consumers, investors, and businesses alike. Let's explore three crucial areas where their decisions make a significant impact.

1. Stock Markets

Stock markets are often sensitive to central bank actions. When central banks decide to cut interest rates, it motivates investors to seek higher yields in riskier investments, such as stocks. Consequently, stock prices tend to rise. Conversely, higher interest rates can dampen investor appetite for equities, causing market downturns.

2. Foreign Exchange Markets

Central banks play a critical role in maintaining exchange rate stability between currencies. By directly buying or selling currencies, they can influence supply and demand dynamics, thus impacting exchange rates. Changes in exchange rates, in turn, affect international trade, export competitiveness, and global capital flows.

3. Bond Markets

Bond markets react significantly to central bank policies, as they directly influence borrowing costs and yield curves. When central banks decrease interest rates, bond prices rise, enabling governments and corporations to borrow at lower costs. Alternatively, higher interest rates can lead to a drop in bond prices, increasing borrowing costs and potentially tightening credit conditions.

The Global Economy and Your Finances

The symbiotic relationship between central banks and world markets has broader implications for the global economy and your personal finances.

1. Economic Growth

Central banks implement policies that aim to stimulate or cool down economic growth. By manipulating interest rates and money supply, they can impact various economic indicators, including GDP growth, employment levels, and inflation rates.

2. Inflation

Central banks closely monitor inflation rates and adjust monetary policy accordingly. Low inflation stimulates consumer spending and economic growth. Conversely, high inflation erodes purchasing power, decreasing consumer spending, and potentially leading to economic instability.

3. Asset Prices

Central bank actions, particularly in the form of quantitative easing, can have inflationary consequences. This liquidity injection stimulates demand for assets like stocks, real estate, and commodities, often driving up their prices. As a result, asset price bubbles may emerge, posing risks to financial stability.

4. Savers and Borrowers

Monetary policy decisions directly impact savers and borrowers. Savers may face lower interest rates on their deposits, limiting their ability to generate returns. Conversely, borrowers can benefit from access to cheaper credit when central banks decrease interest rates.

The Future of the Central Bank-World Market Relationship

As technology advances and new challenges emerge, the central bank-world market relationship continues to evolve. Central banks are now closely scrutinizing the rise of cryptocurrencies, exploring their potential impact on the stability of the financial system.

Moreover, the COVID-19 pandemic exposed vulnerabilities and forced central banks to adopt unprecedented measures to combat economic downturns. The debate surrounding the limits of central bank actions and potential long-term consequences remains ongoing.

Central banks hold the keys to the kingdom of world markets, wielding immense influence over the global economy. Understanding their role and the intricate relationship between central banks and world markets is crucial for both investors and everyday individuals, as their decisions shape the financial landscape that impacts our everyday lives.

So the next time you read a news headline about central banks and their latest policy decisions, remember that it's not just a matter of economic jargon, but a force shaping the world as we know it.

5 out of 5

| Language | : | English |

| File size | : | 2017 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 80 pages |

“Central Banks and World Markets - How to Detect Early Warning Signals of Financial Distress”

Description:

Attention all Investors, Chairmen, CEOs, CIOs, CROs, Board Members who want to get practical high-level assessments of Central Banks operations and decisions by detecting early warning signals of financial distress.

The world economy is going through a phase that cannot be described as normal. In fact, this book addresses the core issues that are not fully captured by conventional models and can be summarized as follows:

- Unstable financial systems involve enhanced risk. If models do not understand in full what is going on, can Central Banks be relied upon to deliver the best policy options? Can we be sure our balance sheets are safe?

- Central Banks Officials increasingly accepted the view that inflation is a monetary phenomenon.

- When the financial sector rises to 350% of GDP, it becomes hungry for higher yields. The corporate sector has not acted in recent years in its own self-interest by ignoring demand, the key driver of its own revenues.

- Under deflation, the time value of money is reversed. A dollar next year is worth more than a dollar now. The generalized fall in yields has driven important structural changes in financial markets.

- Across the Organization for Economic Co-operation and Development (OECD) countries, the money supply has increased by more than 5% a year without generating similar increases in inflation.

- Central Banks increased their assets by more than three times since 2007.

... And much, MUCH More!

This book provides high-level insights on how to detect what is wrong at the system level in today's markets. It also provides coherent assessments on how to detect early warning signals of financial distress for better decision making and priority risk detection, in a timely manner. Forewarned is forearmed.

Get Started Right Now

So go ahead, click the order button right now, and you’re on your way to “Central Banks and World Markets - How to Detect Early Warning Signals of Financial Distress!”

(OPTION #1 – Kindle / eBook Version) In just a couple of minutes, you’ll have your hands on the electronic version of this breakthrough book that will show you exactly how to understand World-Macro dynamics to detect early warning signals of financial distress.

(OPTION #2 – Physical Book Version) In a very short time, you’ll have in your hands this breakthrough book that will show you exactly how to understand World-Macro dynamics to detect early warning signals of financial distress.

Act now! Buy now!

Anthony Burgess

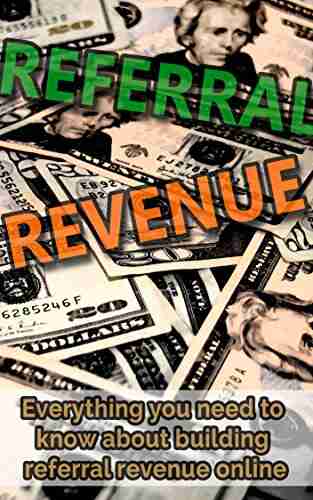

Anthony BurgessEverything You Need To Know About Building Referral...

Are you looking for ways to boost revenue...

Aleksandr Pushkin

Aleksandr PushkinThe Fascinating History of Afro Uruguay - Unveiling the...

Afro Uruguay refers to the rich and diverse...

Anton Foster

Anton FosterReflections From Stubborn Son: A Journey of...

Have you ever encountered a stubborn...

Brennan Blair

Brennan BlairDiscover the Revolutionary World of Protein Modelling:...

Protein modelling is an essential...

Ricky Bell

Ricky BellThe Best Old Fashioned Advice: Timeless Wisdom Passed...

Have you ever turned to your grandparents,...

Isaiah Price

Isaiah PriceEmbark on an Unforgettable Journey: The Sword and Sorcery...

Are you ready to be...

Hassan Cox

Hassan CoxThe Enchanting World of Wendy Darling Comes Alive in...

Step into the magical world of Neverland...

Ivan Turner

Ivan TurnerAdsorption Calculations And Modelling Chi Tien: Unlocking...

In the field of chemistry, adsorption is a...

Harvey Hughes

Harvey HughesUnleashing the Full Potential of a Team: How To Organize...

"Genius is 1% inspiration and 99%...

Desmond Foster

Desmond FosterThe Fascinating Journey of George Romanes: From...

George John Romanes, born on May 20, 1848,...

Adrien Blair

Adrien BlairThe Untold Truth: The Bible In The Early Church - A...

Lorem ipsum dolor sit amet, consectetur...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Terence NelsonWeight Loss, Hair Growth, and Natural Skincare: Essential Tips for You and...

Terence NelsonWeight Loss, Hair Growth, and Natural Skincare: Essential Tips for You and... Stanley BellFollow ·4.8k

Stanley BellFollow ·4.8k Gordon CoxFollow ·8.9k

Gordon CoxFollow ·8.9k Glen PowellFollow ·18.1k

Glen PowellFollow ·18.1k W.B. YeatsFollow ·19.1k

W.B. YeatsFollow ·19.1k Noah BlairFollow ·8.7k

Noah BlairFollow ·8.7k Jaime MitchellFollow ·7.4k

Jaime MitchellFollow ·7.4k Edmund HayesFollow ·15k

Edmund HayesFollow ·15k Grayson BellFollow ·16.8k

Grayson BellFollow ·16.8k