Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

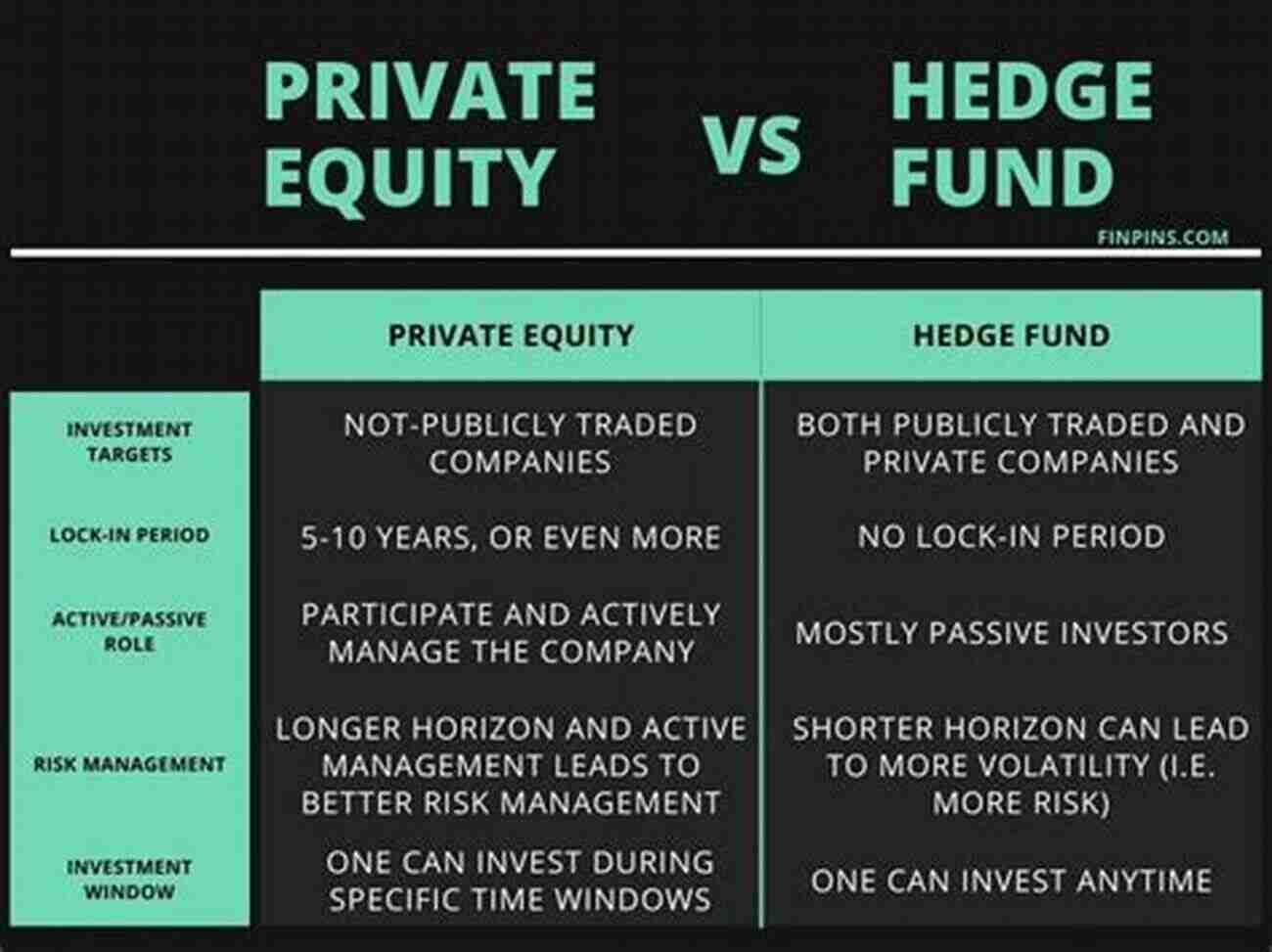

Discover the Hidden Power of Hedge Funds, Private Equity, and Fund of Funds

Are you ready to dive into the world of high finance and explore the secret strategies of hedge funds, private equity, and fund of funds? Buckle up, because this article will take you on a thrilling journey through the intricate web of investment vehicles that drive the global financial markets.

The Rise of Hedge Funds: Unlocking the Power of Alternative Investments

Picture a group of skilled financial wizards harnessing their expertise to generate exceptional returns while outsmarting the traditional investment market. Welcome to the realm of hedge funds. These alternative investment vehicles have gained popularity in recent years due to their unique strategies and ability to generate outsized returns even during turbulent market conditions.

From long/short equity strategies to market-neutral approaches, hedge funds employ a wide array of sophisticated techniques to maximize profits. Their ability to leverage financial instruments, trade in various markets, and adopt unconventional investment strategies provides them with a formidable advantage over traditional investment vehicles.

4.8 out of 5

| Language | : | English |

| File size | : | 2700 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 285 pages |

| Screen Reader | : | Supported |

With long-standing funds like Ray Dalio's Bridgewater Associates and James Simons' Renaissance Technologies pushing the boundaries of what is possible, hedge funds have become a force to be reckoned with in the financial world.

The Allure of Private Equity: Unlocking Value Behind Closed Doors

Ever wondered how companies like Uber, Airbnb, or SpaceX rose to prominence? Chances are, private equity played a crucial role in fueling their growth. Unlike publicly traded companies, private equity firms invest in privately held companies, driving both financial and operational transformation to unlock their true potential.

From venture capital investments in promising startups to leveraged buyouts of mature companies, private equity firms deploy their expertise to generate substantial returns for their investors. By aligning their interests with those of management teams and actively participating in the decision-making process, private equity firms aim to drive sustainable growth and maximize the value of their investments.

With their ability to focus on long-term value creation and take advantage of opportunities inaccessible to public markets, private equity firms have become key players in shaping the business landscape.

The Power of Fund of Funds: Amplifying Returns through Diversification

While hedge funds and private equity may offer significant benefits, they also carry inherent risks. Enter fund of funds - a strategic way for investors to diversify their portfolios and mitigate risk. These investment vehicles provide exposure to multiple hedge funds or private equity funds, allowing investors to access a broader range of investment opportunities while minimizing the risk associated with individual funds.

Fund of funds managers conduct rigorous due diligence to identify and select top-performing funds with complementary strategies. By carefully curating a diversified portfolio, fund of funds managers aim to deliver consistent returns to their investors while managing risk through a well-balanced allocation of capital.

Moreover, fund of funds offer investors the advantage of professional fund selection and monitoring, saving them the arduous task of researching and analyzing individual funds themselves. This allows investors to allocate precious time and resources to other pursuits while still reaping the benefits of alternative investments.

: Unveiling the Secrets of High Finance for Your Investment Journey

Hedge funds, private equity, and fund of funds represent a powerful trio of investment vehicles that have revolutionized the world of finance. By leveraging unique strategies and tapping into alternative opportunities, these vehicles have consistently delivered exceptional returns, paving the way for financial success.

Whether you decide to explore the realm of hedge funds, access the hidden values in private equity, or harness the power of diversification through fund of funds, understanding the underlying principles and risks associated with each investment vehicle is crucial for your investment journey.

So, put on your financial detective hat and unlock the secrets of high finance that could ultimately shape your financial future.

4.8 out of 5

| Language | : | English |

| File size | : | 2700 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 285 pages |

| Screen Reader | : | Supported |

Alternative investments such as hedge funds, private equity, and fund of funds continue to be of strong interest among the investment community. As these investment strategies have become increasingly complex, fund managers have continued to devote more time and resources towards developing best practice operations to support the actual trade processing, fund accounting, and back-office mechanics that allow these strategies to function. Representative of this operational growth, estimates have indicated that fund managers have seen increased operating budgets of 30% or more in recent years.

In today’s highly regulated environment, alternative investment managers have also increasingly had to integrate rigorous compliance and cybersecurity oversight into fund operations. Additionally, with recent advances in artificial intelligence and big data analysis, fund managers are devoting larger portions of their information technology budgets towards realizing technology-based operational efficiencies. Alternative investment fund service providers have also substantially increased their scope and breadth of their operations-related services. Furthermore, investors are increasingly performing deep-dive due diligence on fund manager operations at both fund level and management company levels.

This book provides current and practical guidance on the foundations of how alternative investment managers build and manage their operations. While other publications have focused on generalized overviews of historical trading procedures across multiple asset classes, and the technical intricacies of specific legacy operational procedures, Alternative Investment Operations will be the first book to focus on explaining up-to-date information on the specific real-world operational practices actually employed by alternative investment managers. This book will focus on how to actually establish and manage fund operations. Alternative Investment Operations will be an invaluable up-to-date resource for fund managers and their operations personnel as well as investors and service providers on the implementation and management of best practice operations.

Anthony Burgess

Anthony BurgessEverything You Need To Know About Building Referral...

Are you looking for ways to boost revenue...

Aleksandr Pushkin

Aleksandr PushkinThe Fascinating History of Afro Uruguay - Unveiling the...

Afro Uruguay refers to the rich and diverse...

Anton Foster

Anton FosterReflections From Stubborn Son: A Journey of...

Have you ever encountered a stubborn...

Brennan Blair

Brennan BlairDiscover the Revolutionary World of Protein Modelling:...

Protein modelling is an essential...

Ricky Bell

Ricky BellThe Best Old Fashioned Advice: Timeless Wisdom Passed...

Have you ever turned to your grandparents,...

Isaiah Price

Isaiah PriceEmbark on an Unforgettable Journey: The Sword and Sorcery...

Are you ready to be...

Hassan Cox

Hassan CoxThe Enchanting World of Wendy Darling Comes Alive in...

Step into the magical world of Neverland...

Ivan Turner

Ivan TurnerAdsorption Calculations And Modelling Chi Tien: Unlocking...

In the field of chemistry, adsorption is a...

Harvey Hughes

Harvey HughesUnleashing the Full Potential of a Team: How To Organize...

"Genius is 1% inspiration and 99%...

Desmond Foster

Desmond FosterThe Fascinating Journey of George Romanes: From...

George John Romanes, born on May 20, 1848,...

Adrien Blair

Adrien BlairThe Untold Truth: The Bible In The Early Church - A...

Lorem ipsum dolor sit amet, consectetur...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Carter HayesSpiritual Approach To Emergent Technology: Unveiling the Symbiosis Between...

Carter HayesSpiritual Approach To Emergent Technology: Unveiling the Symbiosis Between...

Fabian MitchellVoices From Chicago Public Housing: Unveiling Untold Stories - A Voice Of...

Fabian MitchellVoices From Chicago Public Housing: Unveiling Untold Stories - A Voice Of...

Salman RushdieUnlocking the Depths of Herman Melville's "The Paradise Of Bachelors And The...

Salman RushdieUnlocking the Depths of Herman Melville's "The Paradise Of Bachelors And The... Abe MitchellFollow ·5.1k

Abe MitchellFollow ·5.1k Andrew BellFollow ·16.2k

Andrew BellFollow ·16.2k Javier BellFollow ·7.1k

Javier BellFollow ·7.1k Harold BlairFollow ·8.2k

Harold BlairFollow ·8.2k Pete BlairFollow ·13.6k

Pete BlairFollow ·13.6k Jean BlairFollow ·3.4k

Jean BlairFollow ·3.4k Russell MitchellFollow ·17.4k

Russell MitchellFollow ·17.4k Wade CoxFollow ·11.8k

Wade CoxFollow ·11.8k